Home » Mutual Funds

Mutual Funds

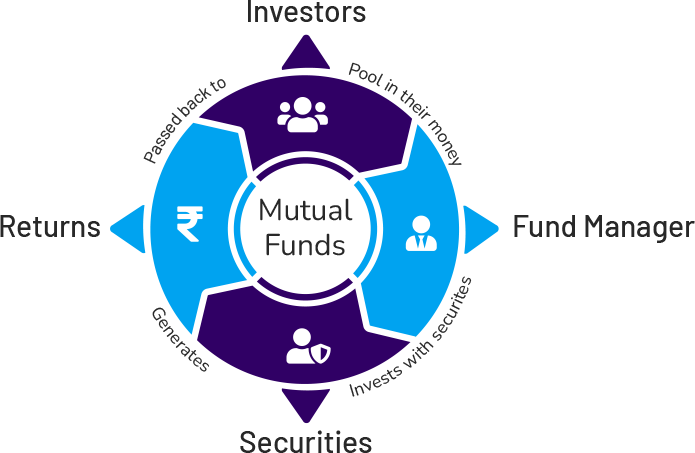

How do Mutual Funds work?

Mutual Funds are governed by SEBI (Mutual Funds) Regulations, 1996.

Advantages of Mutual Funds

Expertise

Investing in Equity directly requires you to monitor the market and time then market. In case of Mutual Funds, Professional Fund Managers research markets and make decisions on your behalf.

Transparency

Mutual Fund operations are transparent. Data about the schemes holding and value are published daily on the AMFI website and on the website of the fund.

Minimal investment criteria

You can commence investments with just Rs.500/-. Secondly, one can make lumpsum Investments or invest regularly through periodical SIP (Systematic Investment Plan).

Ease of investment

The entire Mutual Fund investing from opening an account to transacting can be performed through the digital mode.

Liquidity

Excluding ELSS (Tax Savings) Mutual Fund Schemes which have a lock-in of 3 years and Retirement or Children’s Funds which have a lock-in of 5 years, all other Mutual Fund Schemes can be redeemed at any point in time. In certain Schemes, an exit load will be applicable if the investment is redeemed before a specified time period.

Expertise

There are Mutual Fund Schemes to suit different investor types based on their risk profile, return expectation, investment horizon, and the nature of financial goals.

Tax benefits

Investment in ELSS (Tax Savings) Mutual Fund Schemes is eligible for deduction under Section 80C of the Income Tax Act.

Long Term Capital Gains on Equity Oriented Mutual Fund Schemes exceeding Rupees 1 lakh are taxed at 10% under Section 112A.

Short Term Capital Gains on Equity Oriented Mutual Fund Schemes are taxed at 15% under Section 111A.

Note: Equity Oriented Mutual Fund Schemes are schemes that invest minimum of 65% of its total proceeds in equity shares of domestic companies

| Equity Schemes (based on market cap of investee companies in which they invest) | Large Cap, Large & Mid Cap, Mid Cap, Small Cap, Flexi Cap, Multi Cap | Suitable for investors with moderately high risk to very high risk profile with a 5 to 7 years investment horizon for wealth creation / attainment of financial goals. |

|---|---|---|

| Equity Schemes (based on investment philosophy) | Value Fund, Contra Fund, Focused Fund, Sectoral/ Thematic Fund, ELSS Fund | |

| Debt Schemes | Overnight Fund, Liquid Fund, Ultra Short Duration Fund, Low Duration Fund, Money Market Fund, Short Duration Fund, Medium Duration Fund, Medium to Long Duration Fund, Long Duration Fund, Dynamic Bond Fund, Corporate Bond Fund, Credit Risk Fund, Banking & PSU Fund, Gilt Fund, Floater Fund | Suitable for investors with low to moderate risk profile with investment horizon of 1 day to 7 years for range bound returns. |

| Hybrid Schemes | Conservative Hybrid Fund, Balanced Hybrid Fund, Aggressive Hybrid Fund, Balanced Advantage Fund, Multi Asset Allocation, Arbitrage Funds, Equity Savings | Suitable for investors with low to moderate risk profile seeking balance of risk and returns with 1 to 3 years investment horizon for better than fixed income product returns. |

| Solutions Oriented Schemes | Children’s Fund, Retirement Fund | Suitable for investors with moderately high risk to high risk profiles with a 5 years + investment horizon for creating a Retirement or Child Education Corpus. |

| Other Schemes | Index Funds, Fund of Funds (Domestic/ Overseas) | Suitable for investors with moderately high risk to very high risk profile with a 5 to 7 years investment horizon for wealth creation/ attainment of financial goals |