Home » Will Writing

Will Writing

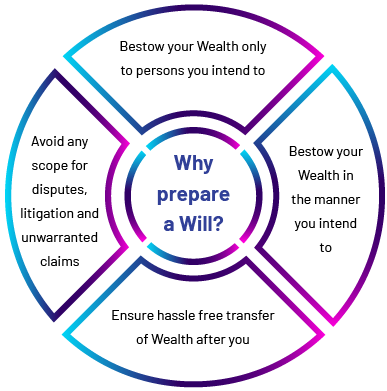

Writing and executing a Will is the last and most important step in the Financial Planning process. It is critical that your Wealth earned and built over a life-time should pass to your loved ones smoothly as per your intent. We offer Will Writing Services as part of our holistic bouquet of offerings to ensure that all needs of our Client’s related to Wealth Management are met under one roof.

What is a Will?

A valid Will has been defined under the Indian Succession Act, 1925 as "the legal declaration of the intention of the testator, with respect to his property, which he desires to be carried into effect after his death." In simpler words, a Will is an instrument by which a person can bequeath (give/ hand down/ confer/ bestow) his property after his death to persons of his choice and in the manner in which he chooses.

Who can make a Will?

The Will must be in line with the law and be made by someone who is competent to make it. In other words, for the Will to be valid in law, the person who makes a Will needs to be a major; of sound mind; and free from fraud, coercion and undue influence.

Does the Will have to be Stamped?

A Will must be in writing and can be on plain paper.

Does the Will have to be drafted in any specific legal language?

Preparation of Will does not require any specific legal language. The intention of the testator has to be ascertainable from the Will.

Who will be the signatory to the Will?

The Will must be signed by the testator and attested by two or more witnesses. Ideally, the witnesses should not be beneficiaries under the Will. It is also not necessary for the witnesses to know the content of the Will.

Can a Will be changed?

Yes, it can be. The testator could create a codicil and change only elements of the old Will that he desires to change. Alternately, he can create a new Will (and in that Will state that he is revoking all old Wills) with the changed clauses. A Will should be revisited when a) there is a significant addition/ deletion of assets, b) a fresh liability has been incurred, c) one needs to change the executor or beneficiaries or the method/ proportion of share to the beneficiaries, d) birth in the family, e) one needs to appoint/ change guardian for minor children, etc.

Does a Will need to be registered?

The registration of instruments is covered by the provisions of the Indian Registration Act, 1908. A Will is an instrument that does not need to be compulsorily registered. Theoretically, a Will that is not registered is as valid as one that is registered. However, even a registered Will can be challenged on grounds of insanity, coercion, fraud, and undue influence.

Can a registered Will be revoked?

Yes, even a registered Will can be revoked and replaced with a subsequent Will. The new Will would also need to get registered as well. Alternately, a registered Will can be revoked by registering a Deed of Revocation.

Can a Will get automatically revoked?

For Parsis and Christians, the marriage of the testator automatically revokes previous Wills. However, the in the event of divorce, the Will does not get revoked.

When a person has made nominations, is a Will necessary?

Generally, a nominee is only a trustee for the property. Nomination does not confer any permanent or legal right in favour of the nominee. In most cases, the Will would take precedence over the nomination. However, the law under which the nomination is being made needs to be examined to understand whether nomination would prevail or not. For financial instruments governed by the Companies Act, however, it is the nominee who would own the asset after the demise of the current holder. This is applicable to the following financial instruments/ accounts: shares or other financial instruments held in dematerialised form with a depository, corporate bonds, corporate debentures, corporate fixed deposits and physically held shares. However, the product structure of this set of financial instruments is such that one is allowed to name only one nominee. For these instruments, the benefit of a Will is in stating the alternate beneficiaries (beneficiaries who should receive the proceeds in the event of the nominee pre-deceases the testator).

What are the essential things that are required to be covered while preparing a Will?

The Will should contain:

- Clear identification of the testator

- Appointment of executor/s

- Details of bequest

- Revocation of earlier Wills, if any

- Residual clause which provides for bequeathing any property not specifically listed in the Will

- Date of execution of the Will

- Signatures of the testator and two witnesses.

Ideally a Doctors Certificate certifying that the testator is of sound mind and is not under the influence of alcohol while executing the Will should be obtained and such certificate should form part of the Will.

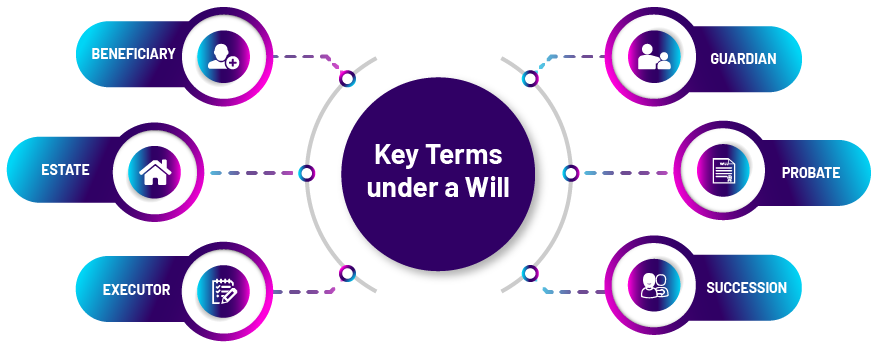

What are the Key Terms under a Will?

Beneficiary

A beneficiary is a person (family or friends) or an organization (for example, a charity) to whom the testator has bequeathed a part or all his assets in the Will. A beneficiary may also act as an executor of the Will. Ideally, one should not make a beneficiary one of the witnesses to the Will.

Estate

Estate is a legal word to represent everything owned by the testator, including movable and immovable property, and financial assets.

Executor

An executor is responsible for implementing the testator’s wishes as set out in the Will, after his demise. One can appoint one’s spouse, relative or a friend to act as an executor. It is also possible to avail paid services of an institutional executor. Appointment of an executor requires considerable thought on the part of the testator. The executor needs to be fair and ethical, capable of executing the Will, and should have the inclination to spend the time required in executing the Will. The testator should ideally appoint an executor who is younger than him to improve the probability of the executor outliving the testator. It is also important to seek the consent of the person to be appointed as executor. A beneficiary under a Will can be an executor. A witness too can be an executor.

Guardian

A guardian is a person named by the testator in the Will to look after his minor children after his demise. A child would attain legal majority at the age of 18 unless a guardian was appointed during the minority of the child in which case, a child attains majority at the age of 21. If the guardian one chooses is not an executor, the guardian would not have automatic access to money one may leave for one’s children. Instead, they would get funds to raise the children from the executor.

Probate

A probate is a copy of a Will certified under the seal of a court of competent jurisdiction with a grant of administration of the testator’s estate to the executors and is essentially a decree declaring the correctness and legality of the Will. It establishes the right of the beneficiary to the asset being inherited.

Succession

‘Succession’ in relation to property and rights and interests in property generally implies ‘passing of an interest from one person to another’. The laws governing succession are applicable only to that person who is desirous of making a will or preparing an estate plan, and not to his or her heirs. The laws that govern succession largely depend on three factors:

- Where the property that is to devolve is situate;

- The domicile of an individual at the time of his death; and

- The religion of the deceased.

In the case of immovable property in India, the laws of India are applicable, irrespective of where the deceased has his domicile. In case of movable property, the law of the country in which the deceased has his domicile at the time of his death, is applicable.

Are there restrictions on bequeathing assets to non-resident Indians or foreign nationals?

Yes. Depending on the nature of the asset, the restriction on bequeathing will depend on whether the person is a) a foreign citizen of specified or non-specified countries, b) a foreign citizen but a person of Indian origin (PIO), or c) an Indian citizen but not resident in India (NRI).

What does the executor have to do on death of the testator?

The executor should read out the contents of the Will to the family members. The executor will be required to interact with lawyers, apply to the court for probate, pay all debts from the assets, maintain assets till bequeaths are effected as per the wishes of the testator, etc.

Are court fees payable on issue of probate?

Yes. The court fees will vary from state to state.

Is expert guidance necessary for preparing a Will?

Since a person spends a lifetime to build his wealth for himself and his family, it will be ideal to seek expert guidance while preparing the Will to ensure that post the demise of the testator, there is smooth transfer of the estate to the beneficiaries.